|

Getting your Trinity Audio player ready...

|

On Sept. 30, 2025, the Nigerian government announced its readiness to enforce the payment of taxes by citizens, whether they engage in legitimate or illegitimate forms of work.

This followed Bola Tinubu’s assent to four tax bills on June 26, 2025, as part of his administration’s drive to reform the nation’s financial system.

Before these Acts, Nigeria’s tax framework relied mainly on familiar levies such as Personal Income Tax, Value Added Tax (VAT), and Company Income Tax, measures that historically focused more on formal workers and registered businesses.

The new package, however, is anchored in four laws signed by the president: the Nigeria Tax Act (2025), the Nigeria Tax Administration Act, the Nigeria Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act.

This Act is designed to widen the tax base, tighten administration, and enhance compliance across both the formal and informal sectors.

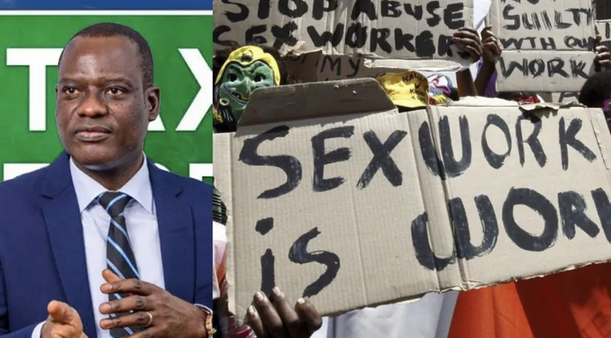

After the announcement, Taiwo Oyedele, the chairman of the presidential committee on fiscal policy and tax reforms, noted that the new tax laws make no distinction between types of work.

He cited sex workers, commonly referred to as “runs girls,” as an example, stressing that they too would be included in the drive to broaden Nigeria’s revenue base.

He stated that the law does not distinguish between “legitimate” or “illegitimate” income sources; what matters is whether a person earns money by rendering a service or selling goods.

Under this approach, sexual services rendered in exchange for payment would, in theory, fall under “services” and thus be subject to taxation.

In this Media and Information Literacy (MIL) article, DUBAWA examines the legal status of sex work in Nigeria and whether sex workers can be taxed under the new fiscal policy.

The legal position of sex workers in Nigeria

In Nigeria, the legal status of sex work is complex and varies from one region to another.

Although DUBAWA’s findings show that there is no single Federal Law that explicitly criminalises prostitution, several state laws, as well as the Criminal Code in the south and the Penal Code in the north, prohibit activities related to it.

The country’s dual legal system further complicates matters. Nigeria operates both common law, which governs most federal and state affairs, and Sharia law, which applies in many northern states.

This mixture of secular and religious legal systems means that what may be tolerated in one part of the country could be strictly outlawed in another.

In practice, several laws, such as the Criminal Code in the South and the Penal Code in the North, criminalise activities connected to sex work, such as brothel keeping, pimping, and solicitation.

To understand how this affects the debate on taxation, DUBAWA spoke with Francis Ochie, a legal practitioner with Veritas University, Abuja. He said that prostitution is still regarded as a crime under Nigerian law, even though enforcement is often inconsistent.

“From a legal standpoint, prostitution is a crime. Ordinarily, one cannot be made to pay tax on the proceeds of crime,” he said.

“What we see in practice is that the authorities tend to look away and regard it as a lesser evil in society. But that does not change its legal status.”

Francis further noted that although the new tax law has not yet come into effect, its eventual enforcement could lead to legal battles.

“When the law is enforced, it will certainly be tested in court. People may challenge it on the grounds of infringement of rights or the contradiction of taxing something the law criminalises,” he added.

His views underline the tension between Nigeria’s criminal laws, which prohibit prostitution, and tax laws that focus only on whether income has been earned, regardless of its source.

“If the government insists on taxing sex workers, the courts may have to step in to decide whether such taxation is constitutional or whether it amounts to legitimising an activity the law currently treats as illegal,” he concluded.

Peter Ineke, a legal practitioner at Goldman Satchette Solicitors, offered a slightly different angle. He clarified that the Nigerian Constitution (1999) itself does not directly criminalise prostitution.

“Instead, what is criminalised under Section 223 of the Criminal Code is the act of procuration, recruiting, coercing, or enticing women and girls into prostitution, or moving them for sex work.

“From a legal standpoint, the Constitution does not exactly criminalise prostitution. What is criminalised is the procurement of persons into prostitution, especially minors. So, in the southern states, individuals who go into sex work on their own volition are not expressly captured by this provision,” he explained.

Still, Peter warned that this does not make sex work legally recognised. “The law may not directly criminalise someone who willingly engages in sex work, but that does not mean the act has legal protection. It still operates outside the bounds of legitimacy,” he added.

In northern states, the picture is less ambiguous. The Penal Code, and in some cases Shariah (Islamic) Law, expressly prohibit prostitution, with punishments ranging from fines and imprisonment to corporal sentences.

This creates a patchwork of enforcement, where sex work is tolerated in some jurisdictions but strictly outlawed in others.

Can income from illegal activity be taxed?

Taxation in Nigeria is governed by laws such as the Personal Income Tax Act (PITA). These laws focus on whether a person earns income, rather than how that income is generated.

Taiwo Oyedele meant this when he said the new tax laws make “no distinction” between legitimate and illegitimate income.

In theory, money earned through illegal activities, such as sex work, smuggling, or cybercrime, could be considered taxable income because it is still a form of earnings.

To better understand whether income from illegal activities can be taxed, Francis explained that under Nigerian law, income, regardless of its source, is subject to taxation.

According to the Nigerian Constitution, everybody must declare their income honestly to the appropriate authorities. There is no constitutional exception for income that comes from illegal sources,” he said.

“The word is income, whether it is legal or illegal; what the law says is that income must be taxed. It doesn’t differentiate the source.”

Francis noted, however, that while the law theoretically empowers tax authorities to collect taxes on all forms of income, enforcing this in practice is a different matter.

“Technically, income from illegal activities is taxable. However, enforcing these provisions is usually very difficult,” he explained.

“The tax man is only interested in the income; whether it is legal or illegal is for the police and the courts to determine.”

He added that such situations often create grey areas in interpretation. “The tax authority will interpret the law in its own way, while those being taxed will interpret it differently. Eventually, it becomes a matter for the courts to decide,” Francis said.

His explanation highlights a key dilemma in Nigeria’s tax framework: while the Personal Income Tax Act (PITA) focuses strictly on income earned, the country’s criminal laws often criminalise the activities that generate such revenue.

This tension raises practical and legal questions about how far tax authorities can go in enforcing payment from individuals whose means of livelihood fall outside the scope of legal recognition.

Conclusion

DUBAWA’s findings highlight the inconsistency with Nigeria’s Tax and criminal laws. As such, the Nigerian government may have to resolve the contradictions in its laws first before it can enforce the payment of taxes by sex workers.